NY AREA MARKET UPDATE

I thought I would devote some space in this newsletter to updating on the Hudson Yards development in Manhattan, one of the largest re-development programs New York has seen.

Hudson Yards was initially planned following NY’s unsuccessful bid to host the 2012 Olympic Games, over 10 years ago. In total it will consist of 40m sq ft of commercial and residential development that will be home to around 5,000 residents. A new school, 14 acres of open space, as well as numerous shops, restaurants and a hotel. In addition the Subway 7 train has been extended to Hudson Yards.

In all it is a $20b regeneration project (with the air rights alone selling for $1b) on the west side of Manhattan bounded by West 42nd and 43rd Streets, 7th and 8th Avenues, West 28th and 30th Streets, and Hudson River Park. This equates to around 60 city blocks.

Engineering wise, it is quite unique. A number of the buildings are being built on two platforms, which had to be constructed to bridge 30 active Long Island Rail Road tracks. More than 300 caissons (large-diameter pipes) have been drilled up to 80ft into the bedrock between the existing tracks to support the buildings and the platform. On top of the platform will rise 30 Hudson Yards, a 90 story office tower, which will be Manhattan’s second tallest.

The first office building, 10 Hudson Yards, opened a little early this summer, with tenants including Coach Inc, SAP and L’Oreal and is fully leased.

The first condo building, 15 Hudson Yards, is just about to launch sales.

More information can be found at www.livehudsonyards.com.

CURRENT NY MARKET INSIGHT

When writing earlier in the year I opined that the luxury end of the market ($5m+) was likely to slow. Prices in this segment have continued to rise, though there is now more inventory available, especially in the $10m price bracket. This suggests to me that price growth should ease in this segment.

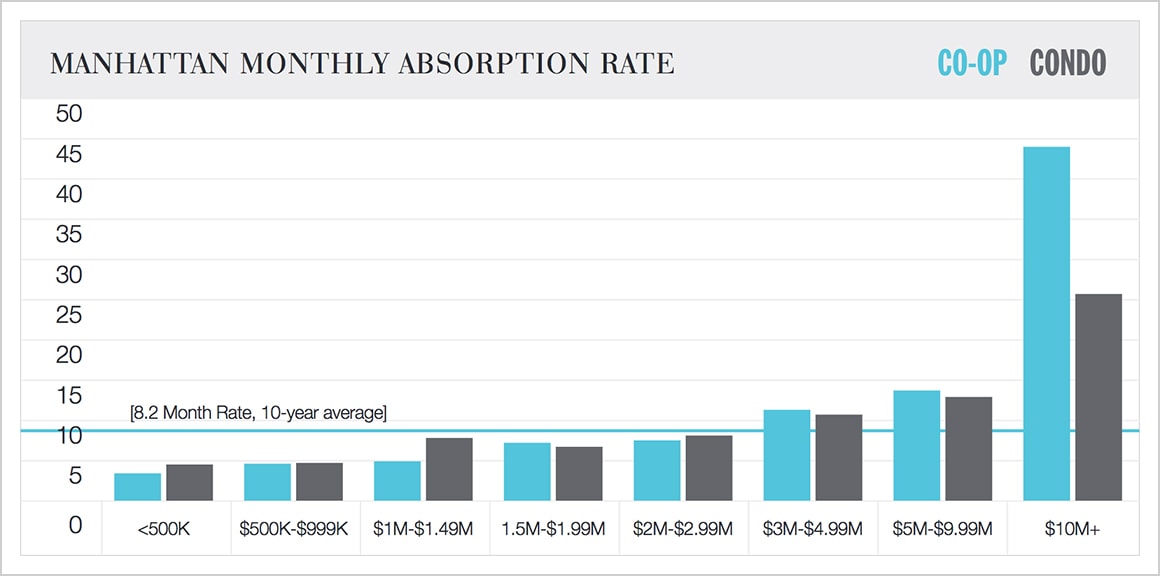

One of the metrics I like to use is the Monthly Absorption Rate Comparison, produced by Miller Samuel, as it highlights the 10 year market wide average absorption. What this metric shows is that property priced up to $3m, is still resolutely below the 10 year average, and backs up my belief that this segment of the market is both still undersupplied and retains the greatest potential for capital appreciation.

In the sub $1m market, condos took an average of 4.7 months to sell (from initial listing to the sales transaction completing), much quicker than the market average of 8.6 months.

In regards to the rental market, the number of leases in NY is at the highest level since 2008. The strong NY area economy continues to drive demand from renters. Though with more apartment buildings (available to lease only versus condos, which can be purchased and leased) having been completed, demand is not quite able to overpower supply, so rent level growth is a little slower than has been seen in the last 2 to 3 years. The average rent concession in the market has increased slightly from 1.2 months of free rent to 1.4 months.

Investment wise, the NY area continues to attract inward investment, with China based investors responsible for $5b of commercial real estate purchases in the first half of 2016, a 19% year on year increase. In terms of residential; international investors continue to be active with The Greenland Group owning 70% of Pacific Park, Brooklyn’s largest residential project. In Jersey City, developer China Overseas America, has broken ground at 99 Hudson St, which is set to become NJ’s tallest building.

EXAMPLE NY NEW DEVELOPMENT PROJECTS

1399 Park Avenue

I plan to send a separate EDM covering this new building over the next few days, pricing from $680k.

15 Hudson Yards

Related Groups first foray at Hudson Yards will see 285 condos with pricing likely to start around $2m.

101 Wall Street

A conversion of a historic Wall St building into 52 condos, located in the heart of the Financial District, which has seen its population double in the last 15 years. Pricing from $1.2m.

Gramercy Square

Located in Gramercy Park close to Union Square and the East Village, 223 condos over 4 interconnected buildings, surrounded by gardens. Pricing from $1.2m.

389 East 89th Street

Launched earlier this year, close to the new 2nd Avenue Subway in the Upper East Side. Pricing from $800k.

As always, many thanks for your continued business and should you have any questions, please do not hesitate to contact me.

Alistair Auty | Partner

info@jmaprop.com