NEW YORK AREA MARKET UPDATE

The news from the NY market continues to be positive, where the number of sales in Manhattan is 6% higher than last year. Total sales volume in the city in Q2 was $13.4b, which is a 19% increase on last year, demonstrating the market is still active and growing. In terms of price, between Q2 2016 to Q2 2017, the average sales price is 5% higher.

A little news on two neighbourhoods where a large number of clients own property:

- The Upper East Side was the neighbourhood with largest increase in contracts signed, 12% year over year, which is in part down to the first phase of the 2nd Avenue subway being completed.

- The Financial District saw an increase of 23% in the number of closings over the last year.

The $1m-$4m market is still strong in Manhattan, and is gaining more focus. The average price of new development condos approved by the NY Attorney General’s office has been steadily trending down over the past two years. In 2015, developers were aiming for an average unit price of just under $5m, when the focus was very much on developing high end, luxury buildings. In 2016, that average dropped 24% to just below $3.8m. The trend is continuing, in the first four months of 2017, the average accepted unit price was $3.1m. Now, the average price per sq ft for new development condos is $2,074 which is just $314 per sq ft more than re-sale condos.

There are now more new development buildings offering condos from around $1m, and with price points starting from below $1,800 per sq ft, there is more choice for buyers now than over the last few years.

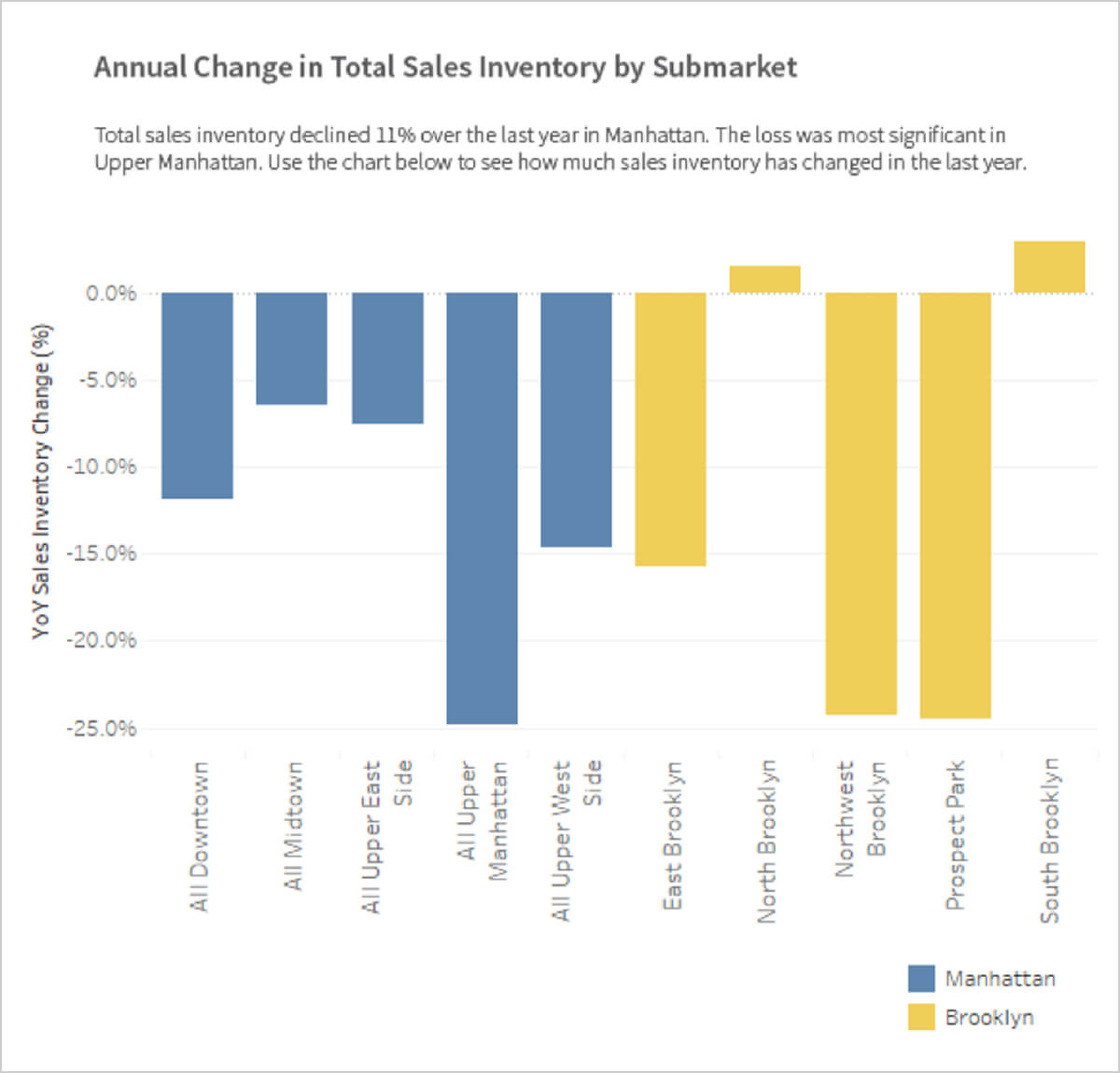

Inventory has declined in Manhattan. There were 11% fewer homes for sale than in April of 2016. According to one report, sales inventory fell the most in Upper Manhattan, the least expensive Manhattan submarket, with 25% fewer homes available than last year.

Given the decreasing inventory and lack of available space to build in Manhattan, developers are turning more to the other 4 boroughs of NYC for the next generation of large projects.

NEW YORK AREA RENTAL MARKET UPDATE

There are 850,000 apartments in NYC. During Q1 2015, only 5,200, or slightly more than 0.5%, were for sale. That’s 26% below the historical average and just 25% above the low of 4,164 in 2013. Why is the number so minuscule? NYC is a renter’s town; rentals make up more than 75% of the apartments in the five boroughs. The rest are almost all co-ops and condos. The current vacancy rate in NYC is 3.8%. Rents are 1% higher year on year.

ROOM MATE LIVING

NYC (and quite possibly other cities will follow) is building rentals with small 3 bedroom apartments designed for room mate living. The apartments each have 3 bedrooms and 2 full bathrooms with a kitchen and dining area, but forego a living room, akin to 3 studios. The ‘living spaces’ are communal common areas within the building. It will be interesting to see how far this concept catches on.

CONDOS v CO-OPS

While international investors have long seen the benefits of condominium ownership over purchasing a co-op, many local buyers are now also starting to migrate towards condos. When buying a new development condo, the ease of purchasing is a clear advantage. With co-op boards often insisting on limited financing or cash only buyers, as well requesting full financials of the prospective buyer and multiple personal references, it is not hard to understand why more and more New Yorker’s are looking to buy condos.

JERSEY CITY UPDATE

New residential buildings have recently been launched, including the high end Park & Shore (429 condos), 10 Provost Street (242 condos) & The Morgan (417 apartments). Future launches include 99 Hudson Street, which will be a 79 story condo tower and Lenox, a 242 unit rental / apartment building. The Wall Street Journal recently penned an article espousing Jersey City’s popularity with developers.

NEW OPPORTUNITIES

Below are two new developments, both are particularly attractive, one for its competitive pricing and central location, the other for its striking design and amenities. Both are scheduled to offer tax abatements that will reduce owner’s running costs.

The Lindley

Located on Third Avenue, between 38th & 39th Street, there will be 74 condos built over 20 floors. The building is very centrally located with five subway lines located a 5 minute walk away at Grand Central Station, as well as Bryant Park, the NY Library and UN headquarters all within a 10 minute walk. The developer is well known to us and has a proven track record. The building has a planned 10 year tax abatement, and is schedule for completion in summer 2018. Pricing from $935k / $1,700 per sq. ft.

Waterline Square

Located between the Hudson River Park and Central Park, this is a collection of three new buildings with many condos offering westerly views across the Hudson. The Waterline Club’s amenities are most impressive. Not only are there top of the range sporting facilities (an indoor soccer field and skate park along with the gym, pool, tennis) but there’s social hub with workstations, a party room, screening/performance space and a business centre and parlour lounge. Pricing from $1.9m, with a 20 year tax abatement planned. The building is scheduled for completion in early 2019.

JMA NEWS

Alistair will be in Asia in during the first half of October and would be more than happy to meet with any clients. Please contact him directly to schedule.

Finally, we hope you like our new website, which was recently completed, and offers both an English and Mandarin version.

As always, thank you for reading and should you have any questions, please do not hesitate to get in touch.

Alistair Auty | Partner

JMA Property Services

Alistair@jmaprop.com

+1 813 520 3110 or +44 7876 133304